Strategic Structuring for Private

Wealth in the UAE

InChub advises private clients and ultra-high-net-worth families on structuring, governance, and long-term wealth planning in the UAE. Our approach focuses on clarity, control, confidentiality, and continuity across generations and jurisdictions.

Who We Work With

We work with private individuals and families with complex wealth profiles who require thoughtful structuring beyond standard solutions.

This includes:

- UAE-based UHNW families

- Families with operating businesses and personal assets

- Individuals with cross-border income or holdings

- Families planning intergenerational wealth transfer

- Clients seeking privacy, asset protection, and regulatory alignment

Recent Work

What Small Businesses Can Learn from the NMC Health Collapse

Learn key lessons from the NMC Health collapse and how small businesses can avoid governance failures, financial mismanagement, and rapid overexpansion. Read More

Hong Kong Offshore vs UAE Onshore

Learn and compare Hong Kong offshore and UAE onshore business structures, tax implications, operational differences and strategic advantages to choose the right setup. Read More

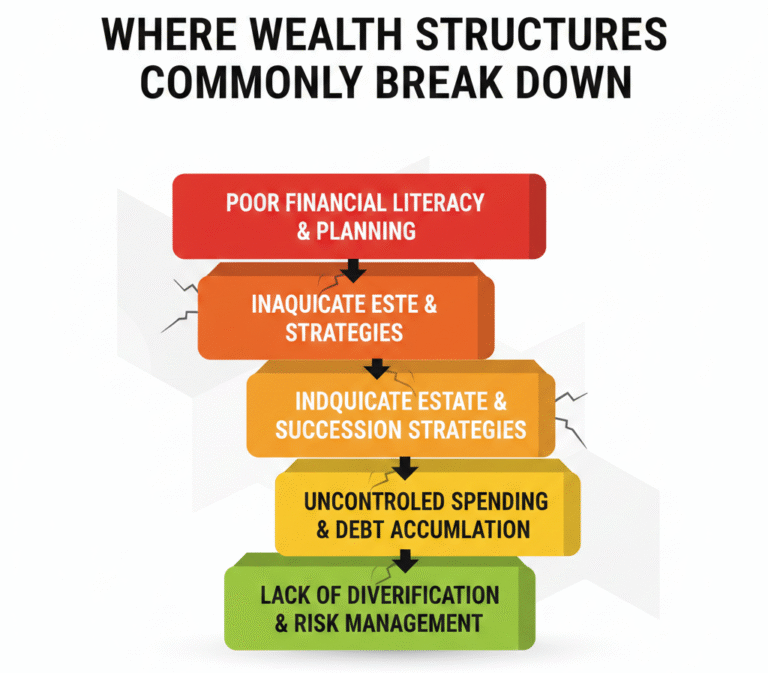

Key Challenges We Address

Private wealth in the UAE presents unique challenges when personal, business, and international interests overlap.

Common issues we help resolve:

- Assets spread across multiple entities with no unified structure

- Exposure to tax, compliance, or regulatory risk

- Lack of formal governance or decision-making framework

- Unclear succession or inheritance planning

- Difficulty balancing privacy with compliance requirements

Scenario Snapshot

A UAE-based family held operating businesses, real estate, and personal investments across multiple entities with no central governance.

InChub advised on restructuring ownership, consolidating assets under a clear holding framework, and aligning succession planning with long-term family objectives. The result was improved control, reduced complexity, and a clear roadmap for the next generation.

Start with a Confidential Review

Whether you are reviewing an existing structure or planning for the future,

a structured advisory conversation is the right first step.

Core Advisory Services for Private Clients

Our services are modular and tailored to each family’s situation.

- Wealth and Asset Structuring

- Personal and family holding structures

- Separation of operating, investment, and personal assets

- UAE and offshore coordination where required

- Governance and Control Frameworks

- Family governance models

- Decision-making and control mechanisms

- Role clarity between family members and advisors

- Succession and Transition Planning

- Intergenerational wealth planning

- Ownership and control transition strategies

- Business continuity alignment

- Tax and Compliance Coordination

- UAE Corporate Tax exposure review

- Cross-border considerations

- Alignment with regulatory requirements

Request a Quote

Confidentiality and Discretion

We understand that privacy is not optional for private clients and UHNW families.

- Strict confidentiality standards

- Controlled information flow

- Discreet advisory engagement

- Trusted coordination with regulated partners

- Your information, structures, and objectives remain protected at every stage.