A family office perspective on navigating 50+ jurisdictions in a tightened regulatory landscape

In 2026, the real question isn’t “which UAE freezone is cheapest?” It’s “which jurisdiction can handle the regulatory reality we’re actually living in, and won’t box us in as rules keep changing?”

After advising families and entrepreneurs through the dramatic regulatory shifts of 2024-2025, I’ve observed a fundamental reality: the freezone you choose today determines not just your operational latitude, but your organization’s ability to adapt as economic substance requirements tighten, corporate transparency mandates expand, and the global tax architecture reaches into every offshore structure.

The 2026 Reality: Why Traditional Selection Criteria Produce Expensive Mistakes

The old framework list activities, count visas, pick cheapest one produced expensive failures throughout 2025. One e-commerce company saved AED 15,000 in setup costs only to spend AED 60,000 restructuring six months later when economic substance scrutiny hit.

The fundamental error: treating UAE freezone selection as cost minimization rather than strategic infrastructure in an era of sudden regulatory enforcement.

The Three Vectors That Actually Matter in 2026

Vector One: Economic Substance: From Theory to Make-or-Break Reality

What was theoretical in 2022 is now audit-critical.

Following 2024–2025 enforcement waves, UAE Economic Substance rules have evolved from “prevent profit shifting” to “prove real operations exist in the UAE.”

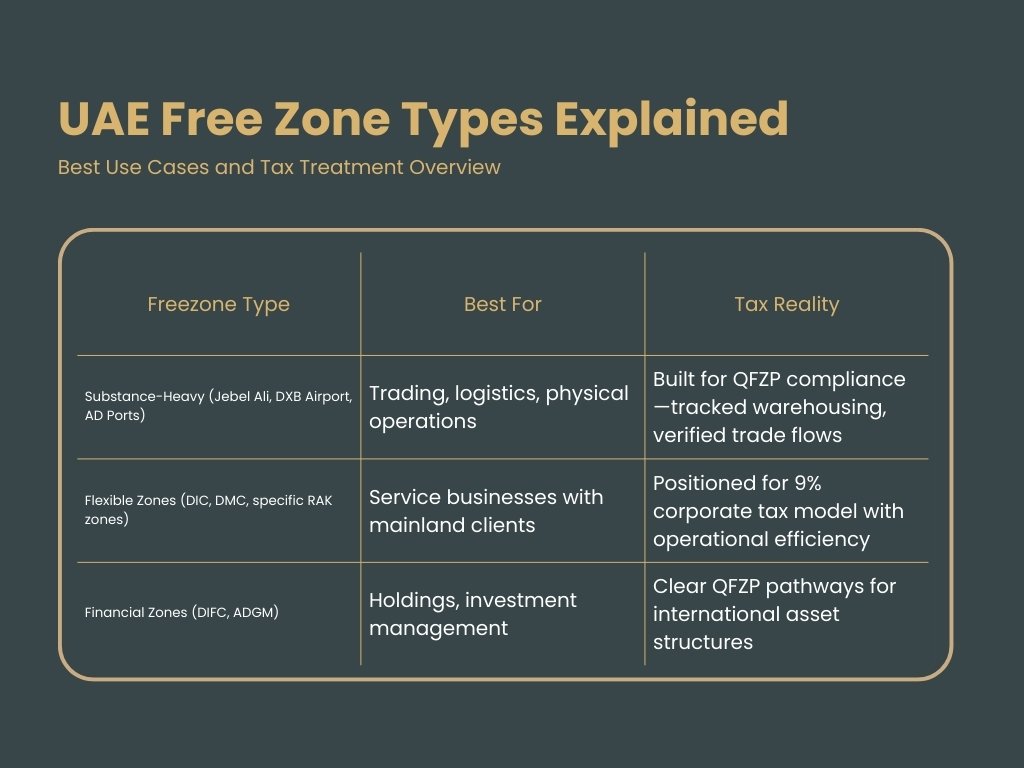

DIFC and ADGM set the gold standard clear guidance on premises, qualified employees, and actual operations. If you’re managing international assets or running financial services, the premium you pay for their documentation standards actually protects you when tax authorities come knocking (and they do now, routinely).

Jebel Ali owns the trading and logistics space. Their 2025 framework explicitly covers warehousing, inventory management, and supply chain verification the exact evidence tax authorities demand when you claim trading income exemptions. The physical infrastructure isn’t just operational; it’s your defense file.

Dubai Commerce City has become the e-commerce answer integrated fulfillment, documented customer service, real logistics. Tax authorities now expect online businesses to prove UAE operations, not just UAE registration.

RAKEZ keeps flexibility but tightened standards significantly in late 2025. Good for smaller operations with genuine local activity, but paper substance won’t survive scrutiny anymore.

The real question: can your business model sustain genuine substance, or are you building a structure that looks good on paper but collapses under audit? Get this wrong and tax residency challenges cascade through everything.

Vector Two: Corporate Tax Architecture and the Mainland-Freezone Calculus

The UAE Corporate Tax regime created a two-tier system:

- 0% Corporate Tax for Qualifying UAE Freezone Persons (QFZP)

- 9% Corporate Tax for all other cases

Critical rule:

If more than 5% of revenue comes from the UAE mainland, QFZP status is lost on all income.

For family offices: holding companies need ADGM/DIFC investment frameworks. Consultancies serving mainland clients need DIC/Knowledge Park without forcing artificial QFZP structures.

The question: which framework matches your actual revenue model? Misalignment creates ongoing compliance costs exceeding setup savings.

Vector Three: The New Transparency Regime and Ultimate Beneficial Ownership

The 2024–2025 UBO reforms transformed the UAE transparency environment.

1: DIFC and ADGM lead with rigorous beneficial ownership registries matching UK and Singapore standards. Their verified documentation is protective for multi-jurisdictional structures—build compliance once, at a standard that satisfies global scrutiny.

2: Mainland-hybrid freezones (Dubai South, Meydan) offer freezone simplicity with mainland market access increasingly attractive post-2025 clarifications.

3: Traditional zones (RAK, UAQ, Ajman) modernized rapidly with proper UBO registries but lack DIFC/ADGM institutional sophistication. Adequate for straightforward businesses; the maturity gap matters for complex holdings.

Insight:

You are choosing a jurisdiction’s future institutional capability, not just today’s compliance.

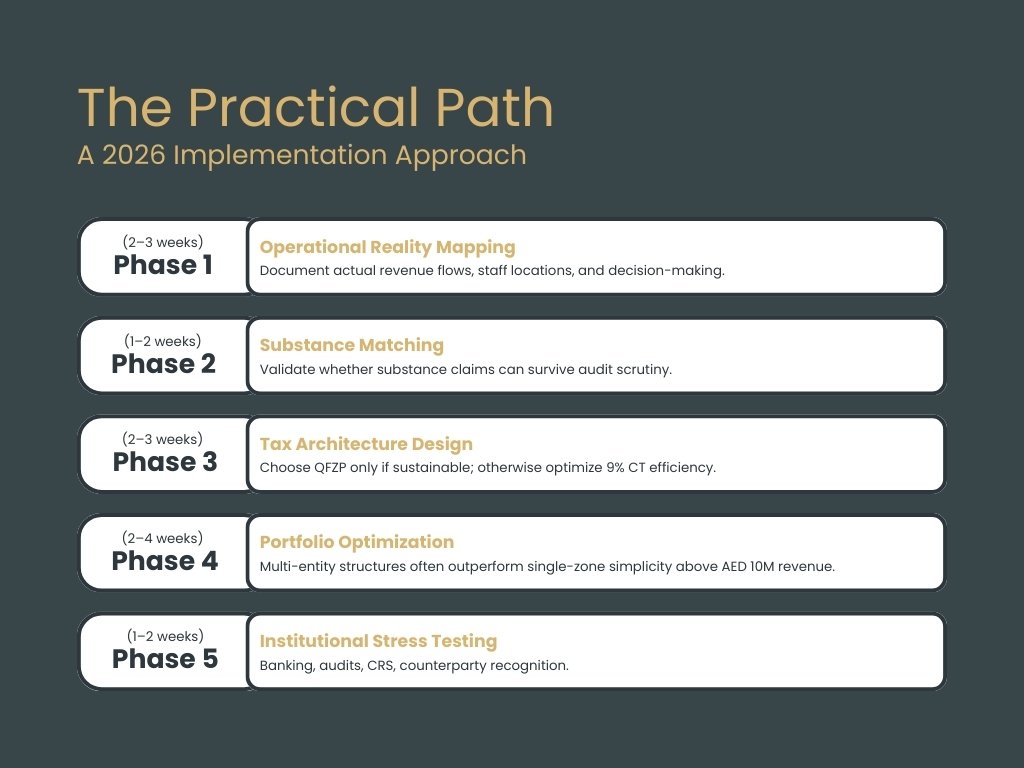

The 2026 Decision Framework: Five Critical Questions

- Where will your actual revenue come from?

If >95% of revenue is genuinely from outside UAE mainland, QFZP-optimized UAE freezones make sense. If you’ll have mixed mainland/international revenue, structure accordingly from day one rather than retrofitting later.

- Can you demonstrate genuine economic substance?

Be ruthlessly honest: Do you have real operations, qualified employees, and adequate premises? Or are you trying to create paper substance? The jurisdictions that will serve you best are those designed for your actual operational reality, not your aspirational structure.

- What does your international footprint look like?

If you’re contracting with Fortune 500 companies, you need DIFC/ADGM credibility. If you’re running a regional business within GCC, many UAE freezones work fine. If you’re managing family wealth across multiple jurisdictions, institutional sophistication matters more than cost.

- How complex is your ownership structure?

Single owner with straightforward shareholding? Most UAE freezones are adequate. Multiple family branches with trust structures and offshore holdings? You need jurisdictions with sophisticated UBO handling and professional service ecosystems (DIFC, ADGM).

- What’s your compliance comfort level?

Do you want maximum oversight and documentation (which protects you during scrutiny)? Or adequate compliance with operational flexibility? There’s no right answer, but misalignment between your comfort level and your jurisdiction’s approach creates friction.

Add Your HeadinThe 2026 Landscape: Opportunities vs. Pitfallsg Text Here

| What Smart Advisors Leverage | What Will Cost You Dearly |

| Hybrid Models: Dubai South, Meydan offer UAE freezone simplicity + mainland access | Cost-First Selection: Cheapest option often means banking difficulties, tax complications |

| Sector Advantages: Healthcare City, Knowledge Park, Media City have regulatory frameworks beyond cost savings | Easy Migration Myth: Licenses don’t transfer, banking resets, tax history follows you |

| Golden Visa Strategies: Multiple pathways across family members and key employees | Ignoring Substance: Paper operations trigger tax residency challenges in 2026 |

| Outdated Advisors: Pre-2023 advice misses corporate tax and substance realities | |

| Copying Competitors: Their structure fits their reality, not yours |

The 2026 Imperative

The UAE’s 50+ freezones offer sophisticated diversity precisely because economic substance, tax optimization, and international credibility have made one-size-fits-all approaches obsolete.

The businesses that will thrive match their operational reality to jurisdictional frameworks designed for it. Those that struggle are still choosing UAE freezone based on 2019 criteria for a 2026 reality.

The question isn’t which freezone is “best”, it’s which architecture enables your specific business model while providing compliance certainty and institutional credibility. In an age where regulatory scrutiny is routine and tax authorities coordinate globally, that distinction is everything.

Inchub.ae is a UAE-based corporate, tax, and structuring advisory firm specializing in family office advisory, UAE Corporate Tax planning, Economic Substance documentation, and multi-jurisdictional structures.

We advise entrepreneurs, UHNW families, and international groups across DIFC, ADGM, mainland UAE, and select UAE freezone, aligning real operations with sustainable regulatory frameworks.

This content reflects regulatory conditions as of January 2026 and is for informational purposes only.