Offshore Company Formation in UAE

Form your offshore company quickly and easily with our expert support.

Unlock tax savings, protect your assets, and access global markets.

Start your journey today and expand your business worldwide.

Key points about Offshore company formation

Offshore company formation means setting up a business in a foreign country. It’s popular for tax benefits, privacy, and business flexibility. The process involves choosing the right country, registering your business, and following local rules.

Offshore companies allow you to access global markets and protect your assets. They have fewer rules, making them easier to manage. Choosing the right country is key, as each one offers different benefits like lower taxes and better banking options.

It’s important to work with experts who can help you set up the company smoothly. By forming an offshore company, you can grow your business internationally and stay compliant with local laws.

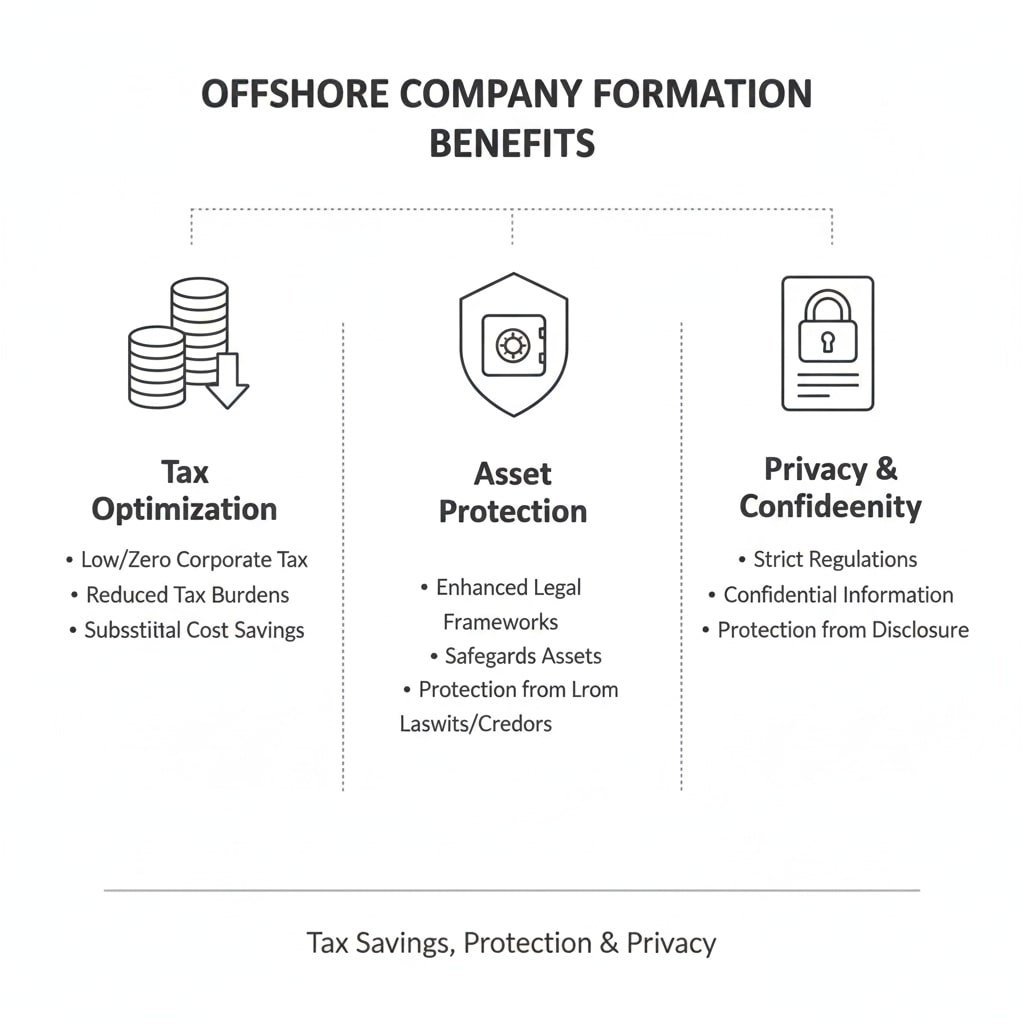

Benefits of Offshore company formation

One of the biggest benefits of offshore companies is tax savings. Many offshore countries have low or no taxes, allowing you to keep more profit. This can reduce your overall tax costs.

Offshore companies also offer privacy. These countries often keep business information confidential. This is great for business owners who want to keep their financials and ownership private.

Another benefit is flexibility. Offshore companies can help you access global banking and simplify international transactions. They also offer better asset protection, keeping your business safe from political or economic risks.

Advantages of Setting up Business in UAE Offshore

Offshore companies provide asset protection. They can help protect your business and personal assets from legal issues or financial instability.

They also make it easier to access global markets. By setting up offshore, you can expand your business across borders with fewer barriers. This is great for businesses that want to grow internationally.

Offshore companies also offer flexible ownership. You can own 100% of your business without local partners. This gives you full control and makes it easier to grow your business on your terms.

Business Incorporation Steps

Process of Offshore Company Setup in Dubai

Setting up an offshore company in Dubai is a straightforward process. First, you choose the right offshore jurisdiction based on your business needs. Next, you complete the registration by submitting the required documents and choosing a company name. Finally, you open a corporate bank account to manage your operations smoothly.

Select The Right Jurisdiction

Choosing the right jurisdiction is crucial for your offshore company. Dubai offers several offshore zones, each with its own benefits. Popular jurisdictions like the Jebel Ali Free Zone (JAFZA), Dubai International Financial Centre (DIFC), and Ras Al Khaimah (RAK) provide various advantages such as tax exemptions, privacy, and ease of international business. The choice of jurisdiction depends on your business goals, type, and target market. It’s important to consider factors like regulatory requirements, cost, and business scope before making your decision.

Prepare Your Documents

The next step is to gather and prepare the necessary documents. This usually includes a valid passport copy, proof of address, business plan, and a no-objection certificate (NOC) if applicable. The documents may vary depending on the chosen jurisdiction, so it’s essential to ensure you have everything required. The preparation of these documents is a key step in speeding up the registration process. Professional assistance can be helpful to ensure all documentation is in order and complies with Dubai’s legal requirements.

Get Your Business License

Once your documents are ready, you can apply for a business license. In Dubai, there are different types of licenses, such as a commercial, professional, or industrial license, depending on the nature of your business. The business license grants you legal permission to operate within Dubai’s offshore zones. The application is submitted to the relevant authorities, and once approved, you’ll receive your official business license. This step is vital to ensure that your business operates legally in Dubai.

Process Your Visa

After obtaining the business license, you can apply for your offshore company visa. This allows you and your employees to live and work in Dubai. The process typically involves submitting documents like passports, photographs, and medical certificates. Offshore companies are often eligible for work and residence visas for their owners and employees, which are linked to the company’s legal status. It’s important to check the visa requirements specific to your jurisdiction to ensure compliance.

Opening A Bank Account

The final step in the process is opening a corporate bank account. Dubai offers a wide range of banking options for offshore companies, including international and local banks. The bank account will be used for your company’s financial transactions. To open a corporate account, you’ll need to provide your business license, proof of address, and personal identification documents. It’s recommended to choose a bank that aligns with your business needs and offers services like online banking and multi-currency accounts to support international operations.

Offshore Company Formation in the UAE

Offshore company formation in Dubai is a smart way to grow your business globally. It gives you tax advantages, strong asset protection, and 100% foreign ownership. Most offshore setups can be done in just a few days with the right help.

The cost usually starts around AED 12,000 and can go up to about AED 25,000 or more, depending on the jurisdiction and services you choose. For example, Ras Al Khaimah (RAK ICC) offshore can cost around AED 7,500–12,000, while JAFZA offshore may range higher, around AED 15,000–20,000. Annual renewal fees also apply and may range between AED 7,500–25,000 each year. Planning your budget helps you choose the best option for your business.

Well Established Offshore jurisdictions

Ready to Take Your Business Global? Start Your

Offshore Company in Dubai Today and Explore New

Growth Opportunities!

Why Choose IncHub for Your Offshore Company Setup Needs?

At IncHub, we make the process of setting up your offshore company in Dubai simple and efficient. We understand the complexities of offshore company formation and provide tailored solutions that meet your specific business goals. Whether you’re a startup or a large enterprise, we guide you through every step, from selecting the right jurisdiction to ensuring full compliance with local regulations. Our team ensures that your business is set up quickly, securely, and with minimal hassle.

With years of experience in the industry, IncHub offers a seamless process for establishing your offshore company. Our clients benefit from expert advice, transparent pricing, and ongoing support, ensuring your business thrives in a tax-efficient environment. We prioritize your needs and ensure that your offshore company setup is done correctly and cost-effectively.

Still confused about taking your decision.

One-Stop Solution

We provide a complete range of services, from company registration to bank account setup, in one place. This saves you time and effort, as everything is managed under one roof. Our team handles all the paperwork and legalities to make the process hassle-free.

Compliance Assurance

IncHub ensures that your offshore company complies with all local and international regulations. We handle all the legal requirements and documentation to ensure your company stays compliant. This helps you avoid legal issues and focus on growing your business.

Expert Team

Our experienced consultants have in-depth knowledge of offshore company setup. They offer personalized advice and guide you throughout the process. With IncHub’s expert team, you can be confident your business is in safe hands.

Offshore Business Setup - FAQs

What is an offshore company?

What are the major benefits of forming an offshore company?

What distinguishes offshore corporations from other businesses?

Despite the fact that all offshore firms are unique in their nature and are governed by the corporate laws of their respective countries, they all have the following characteristics:

They are not subject to taxation in their home country, but that does not imply they are tax-free elsewhere.

Regulation of business operations is more stringent in developed countries, whereas it is less stringent in developing countries.