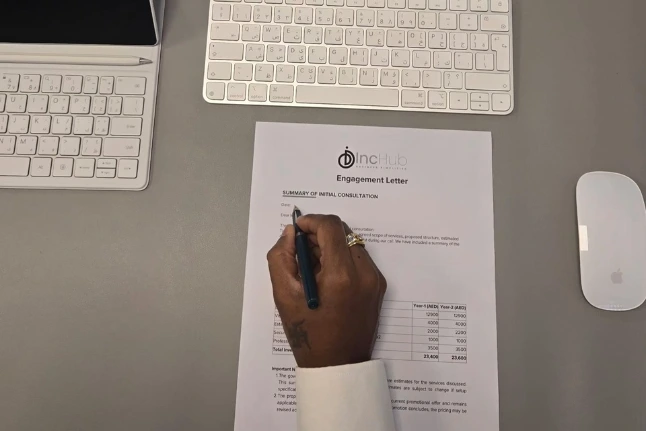

We begin with structure, not paperwork. Before any entity is formed, we assess business intent, ownership dynamics, jurisdictional exposure, and future plans. As a private wealth management advisory firm, this ensures the chosen structure supports growth, control, and compliance over time while aligning with broader wealth, ownership, and long-term planning objectives.

- Al Fajer Business Centre, Dubai UAE

- +971 437 053 38